Due to the political courageousness of President Obama (there is simply no other way to put it), the folks inside the Beltway are finally having a serious discussion about taxing the rich. Obama is not only strongly fighting for higher tax rates on the higher-income earners, but he was the one who put the subject front and center in the election season -- when he could easily have punted it to a non-election year.

But the "tax the rich" policies so far being discussed (at least the ones that leak out to the public) are laughably timid and tame, when you really examine the big picture. So far, what is making Republicans howl is President Obama's plan to end the Bush tax cuts on the top two marginal income tax rates, which would raise them from 33 percent to 36 percent, and from 35 to 39.6 percent. Seen one way, that's impressive, since tax rates haven't gone up in such a fashion since President Clinton's first year in office. But seen another, it's not all that radical at all.

Consider the fact that nothing Obama is doing is going to "fix" the problem of Warren Buffett paying a lower tax rate than his secretary -- a problem Obama has repeatedly said he'd like to tackle. On "entitlements reform," only a few lonely voices crying in the wilderness are suggesting ending the most regressive federal tax around, by scrapping the cap on income for Social Security payroll taxes. Also seemingly forgotten in this debate is the proposal for a "millionaires' tax" or a "transactions tax." The real measure of whether Democrats and Republicans are both selling smoke and mirrors is whether they permanently fix the Alternative Minimum Tax -- again, a subject which has barely been mentioned.

If we're really going to get serious about taxing the rich, why not... well... tax the rich? Chances for changing the tax code for upper-income folks don't come around all that often (it's been 20 years since the last one, remember), so why not push not only for higher rates, but to fix some of the most glaring ways our tax code favors those with monstrous incomes. Let's take a look at a few of these ideas, one by one.

?

Scrap the Cap

This one is pathetically easy to understand, and pathetically easy to fix. Many Americans aren't even aware of how the lower 90 percent of paycheck-earning Americans pay higher taxes than the upper ranks.

Social Security taxes are supposed to be a "flat tax" -- everyone pays the same rate. It's so simple that Social Security taxes ("FICA," on your paystub) don't even appear on a normal person's income tax form. It's a straight 6.2 percent of your income that gets taken out, every single paycheck. Except for the wealthiest, of course -- they pay less.

Because only (currently) the first $110,100 you make in income is taxed. Every dollar you earn up to this limit is taxed at a flat 6.2 percent rate. Every dollar you make over this limit is taxed at a zero percent rate. Meaning most Americans don't make it over the cap, and thus pay a full 6.2 percent on their entire income.

[Technical notes: Right now we are in the midst of a temporary "payroll tax holiday" and only 4.2 percent is being taken out of your paycheck -- but this is going to end at some point, and the tax will go back up to the baseline of 6.2 percent. Also, your employer matches this percentage, but self-employed people pay the full 12.4 percent. Neither of these facts are reflected in the charts below, which have been simplified for clarity.]

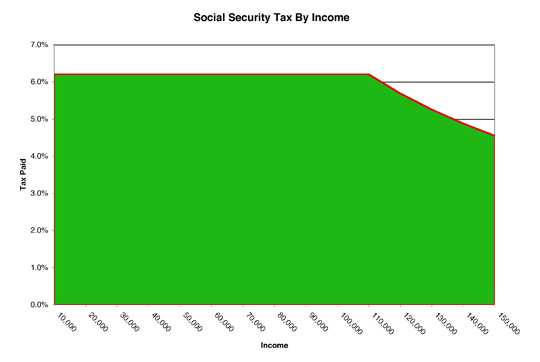

Here is a chart showing what percentage in Social Security taxes people with modest incomes actually pay, from $10,000 to $150,000 income:

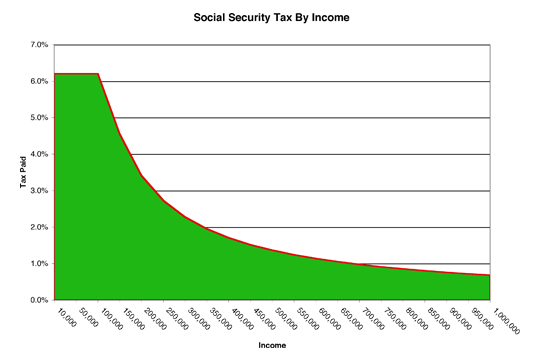

Everyone pays the same 6.2 percent up until that $110,100 limit. From this point on, the percentage drops because once the cap is hit, you're done paying the tax for the year. Someone making $150,000 a year pays only 4.6 percent, as a result. Now let's look at a higher income range -- one which begins to show the massive tax break higher income folks get:

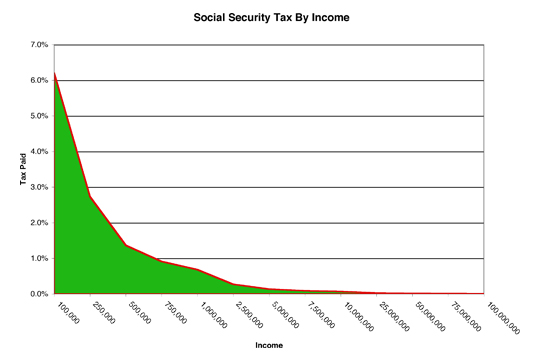

This shows income up to a million dollars a year. The tax rate steeply falls until about $250,000 a year (who pay 2.7 percent), and then falls off more slowly as incomes rise. When you hit $750,000, you are paying less than one percent a year in Social Security taxes. By the time it hits a million bucks a year, it's down to 0.7 percent. Which brings us to the real top earners:

At $5 million a year in income, the tax falls to one-tenth of 1 percent. A firefighter pays 6.2 percent, but if you clear $5 million you pay 0.1 percent. At $75 million a year in income, the figure falls below one one-hundredth of 1 percent -- only 0.009 percent.

Want to "save" Social Security? Scrap the cap. Make everyone pay the same flat percentage rate. Flat taxes are bad enough, but regressive taxes -- defined as "those who have more pay less" -- should be an outrage. Scrap the cap. Social Security could be saved for decades by this one simple step. Make every one of those charts a flat line.

?

Solve the Buffett Problem

Warren Buffett, as everyone should know by now, pays a lower income tax rate than his secretary, despite the fact that Buffett makes one whale of a lot more income than his secretary does. This, despite the supposed-progressive nature of the income tax system. The reason is the biggest loophole of them all. This mother of all loopholes? Treating income rich people make differently than income normal people make. You see, the way Mitt Romney makes most of his money is taxed at a much lower rate than the way a nurse or teacher makes money. Which is why Romney is able to pay less than 14 percent income tax on an income of $20 million. Astonishingly, if the Paul Ryan budget had been made law, Romney would have paid less than one percent on the same $20 million income. I speak, of course, of "capital gains" (and "dividends" as well, but I'm just going to lump them all together for the sake of conversation).

Of all the thousands of ways an individual can make money (or "create an income"), only one is taxed at less than half the rate of the others. It happens to be "making money on Wall Street and the stock market." What a surprise! The method the already-wealthy use to increase their wealth is treated separately by the tax code. It is taxed less than half of what you earn in a paycheck. This is the "Buffett problem."

The solution to this problem is easy, too. Tax all income the same. Equality of taxation! It doesn't matter how you make that dollar, the government should tax it exactly the same -- anything else is simply not fair. In fact, this should be made progressive, too -- which will instantly neutralize all the howling from the anti-taxers about how this will hurt the middle class.

Make all income made through capital gains up to $250,000 each and every year tax-free. No capital gains taxes whatsoever on any money made up to the $250,000 limit -- you can just write off all profits up to that point on your yearly tax form. Then every dollar made above that limit is treated as income. Period. And taxed at the same rate as every other type of income.

This removes the argument that there are small investors who would be harmed. Very few Americans' retirement plans make $250,000 in income each and every year. In fact, it would be a massive tax break for small investors, which would have a positive impact.

But for the Buffetts and the Romneys of the world, they'd be paying the same (or greater) tax rate as their secretaries. And they, too, get to write off a whopping quarter-million of it each and every year, as an incentive. Problem solved.

?

Tax Wall Street Speculators

Institute a transactions tax of 0.25 percent on all Wall Street transactions over a certain limit per year. Make all the stock trades you want up to, perhaps, $250,000 per year tax-free. But then on trades over this amount, charge a fraction of one percent as a "speculation tax." This idea isn't original (actually, none of these ideas is original), I should mention. Raise money for the Treasury by putting a very gentle brake on the stock market, to the tune of 25 cents on every $100 traded. Wall Street bears a large portion of responsibility for our fiscal problems, so it's time to make them contribute toward fixing them.

?

Cap deductions

Right now this is the favorite solution of the Republicans (of course, they want this solution and none of the others, to be clear). Cap what rich people can deduct on their income taxes. The figure I've heard tossed around, however, is way too low. Capping deductions at $50,000 would snare a lot of folks making under $250,000 per year, I would be willing to bet. So raise the limit enormously, but make it a hard cap.

Let upper-income folks have a full quarter-million in deductions each year. They can write off up to $250,000, no matter how they're deducting it and no matter how much their total income (this would be separate from the $250,000 capital gains break described above, I should mention). But that's it. This change could be accomplished by changing a few words on the last box on Schedule A to read "if this amount is over $250,000, then just enter $250,000." That's all it would take. No more writing millions of dollars off each year, sorry. Again, by setting the limit extremely high, this would not ensnare anyone in the middle class at all.

?

Add Two Tax Brackets

This one's pretty easy, too. One of the things Republicans (stretching back to Ronald Reagan) have been successful at over the years is not just lowering tax rates, but reducing the number of tax brackets that exist. Most of this reduction has happened at the upper end of the scale (which should come as no surprise).

This one is easy to fix, and key Democrats such as Sen. Charles Schumer have been pushing the idea for a while now. Create a millionaires' tax bracket. In fact, I'd go further and create a bracket at $1 million in income, and another one at $10 million in income. This removes the squabbling about the "middle class" versus "the truly wealthy" as anyone pulling down a cool million a year simply cannot be classified as "middle class" by anyone (at least not with a straight face). We had multiple tax brackets for a reason in the past -- to tax the stratosphere of the income levels. Let's get back to this way of targeting the upper ranks once again.

?

The AMT Big Lie

I've offered up all of these ideas today to show how timid the proposals currently being discussed truly are. I would bet that none of the problems above will even be addressed in the fiscal cliff negotiations, and I don't expect them to be addressed at any time in the next year, either.

There's a quick and easy way to show how the politicians in Washington -- from both sides of the aisle, mind you -- are simply playing games when they talk about any "long-term solutions" to the tax code. They are, indeed, not going to institute a fix on any sort of permanent basis, mostly because then they'd have to tell a certain uncomfortable truth about the budget projections. Which they're just not going to do -- from either side of the political divide.

Here's the test: will the Alternative Minimum Tax be fixed for more than one year in any "deal" which emerges? The answer to that will be: "No. No, there will not be a permanent fix to the AMT."

Which is how you will know that both sides are simply lying about what the budget will look like in the next ten years. Flat-out lying. Both sides.

The Alternative Minimum Tax was created to solve exactly the same problem they're trying to solve now -- making the wealthy pay their fair share. It was created to rein in abuse of deductions and loopholes. It was created to make sure the wealthiest paid at least a minimum of taxes (it's right there, in the label). It is, in short, the perfect solution to the problems they're now trying to hash out.

Instead of upping rates, instead of fixing loopholes or deductions, the politicians could instead just fix the AMT and return it to its original purpose of snaring ultra-wealthy folks who are trying to lower their tax liability on each year's tax form.

The problem with the AMT is that the limit was set so long ago that it is laughably low today (Nixon signed the original AMT into law). But the politicians in Washington play a game with it, each and every year, like clockwork. The game is called "let's pretend it's going to exist for nine years out of ten, because it makes the budget projections look so much better." When figuring a ten-year budget, the next year will show an "AMT fix" where the AMT limit is raised to where it should be, to only apply to the very wealthy. But the nine years after that will show the AMT levels at the old rate, because such smoke and mirrors means nine years of "tax revenue" which is simply never going to appear gets added into the mix. With nine years of such falsehood, to put this another way, it makes it much easier to project smaller budget deficits.

Each year, Congress "fixes" the AMT, right before the end of December. Each year, they only fix it for a single year. Nobody wants to be the one who points out the lack of clothing on the Emperor, because then the other side will accuse them of wanting to "explode the deficit."

So while there is indeed a vehicle for taxing the rich in a way which lays down clear rules and clear targets -- a way which has existed since 1970 -- it will not be used in the fiscal cliff deal. A permanent fix will not even be discussed, I would wager.

If President Obama really wanted to clearly and permanently change the tax structure for the wealthiest Americans, he would be out there pushing for all of his ideas to be wrapped into the one package of a permanent AMT fix. Instead, this will be treated as an afterthought in the whole debate -- it'll barely rate a footnote in the stories which appear about any impending deal. Perhaps in the fifteenth paragraph of an in-depth newspaper story will be the line "...and they've also agreed to the standard one-year fix for the AMT."

If you want to tax the rich -- if you really want to address the problems in our tax code that outrageously favor the wealthiest among us -- there are multiple ways to do so. I understand why Obama has drawn a political line in the sand over raising rates on the top 2 percent of earners. But it has focused the debate only on this one part of an overall solution. There are plenty of other ways to make the tax code more fair, more balanced, and more evenhanded for the middle class.

My guess is none of them will happen soon. Perhaps Obama will claim victory and get rates raised to 39.6 percent, or perhaps John Boehner will talk him down to 37 percent. But because the media and all the politicians have focused on this one battle royale, my guess is that virtually no attention will be paid to any of the other fine ideas out there to tax the rich. Which is a shame. Because these opportunities seem to come along only once in a generation.

?

Chris Weigant blogs at: ![]()

Follow Chris on Twitter: @ChrisWeigant

Become a fan of Chris on The Huffington Post

?

?

?

?

Follow Chris Weigant on Twitter: www.twitter.com/ChrisWeigant

"; var coords = [-5, -72]; // display fb-bubble FloatingPrompt.embed(this, html, undefined, 'top', {fp_intersects:1, timeout_remove:2000,ignore_arrow: true, width:236, add_xy:coords, class_name: 'clear-overlay'}); });

Source: http://www.huffingtonpost.com/chris-weigant/if-were-going-to-tax-the-_b_2273852.html

hepatitis c symptoms david bradley david foster wallace pinterest attwireless taylor swift zac efron the scream

No comments:

Post a Comment